Research suggests that, like fluctuations in share prices, changes in interest rates and bond prices are largely unpredictable. It follows that an investment strategy based on attempting to exploit these sorts of fluctuations is unlikely to be a fruitful endeavour. Even so, investors may still be curious about what might happen to equities if interest rates go up.

First, the theory. Unlike bond prices, which tend to go down when yields go up, share prices might rise or fall with changes in interest rates. The price movement can go either way because a share’s price depends on both future cash flows to investors and the discount rate they apply to those expected cash flows. The discount rate – or required rate of return – is the expected return investors demand for holding a share. When interest rates rise, the discount rate may increase, which in turn could cause the price of the share to fall. However, it’s also possible that when interest rates change, expectations about future cash flows generated by holding a stock also adjust.

So, if theory doesn’t tell us what the overall effect should be, what does the data say?

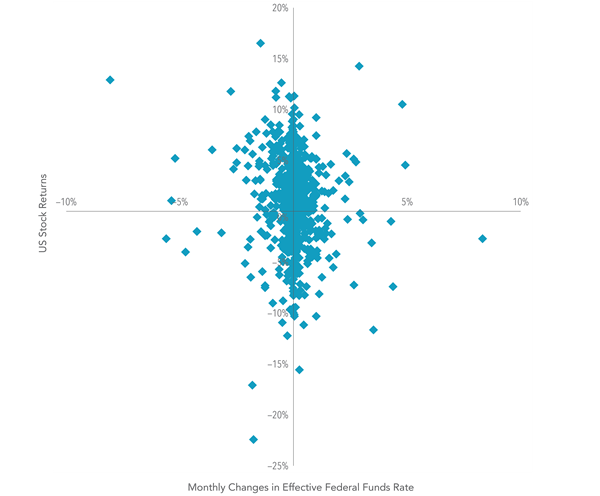

Fortunately, research has been undertaken to explore this area. The research examines the correlation between monthly US equity returns and changes in interest rates. The diagram below indicates that while there is a lot of noise in equity returns and no clear pattern, not much of that variation appears to be related to changes in the effective federal funds rate.

For example, in months when the federal funds rate rose, equity returns were as low as –15.56% and as high as +14.27%. In months when rates fell, returns ranged from –22.41% to +16.52%. Given that there are many other interest rates apart from the federal funds rate, the research also examined longer-term interest rates and found similar results.

Our opening question was: when rates go up, do equity prices go down? The research tells us the answer is ‘yes’, but only about 40% of the time. In the remaining 60% of months, stock returns were positive. This split between positive and negative returns was about the same when examining all months, not just those in which interest rates went up. In other words, there appears to be no clear link between equity returns and interest rate changes.

So what can we conclude from all this? In essence, there’s no evidence either that investors can reliably predict changes in interest rates – or that, even if they could, it would help them make money from their equity investments. This would hold true even if you had perfect knowledge of what would happen with future interest rate changes – this information therefore provides little guidance about subsequent equity returns. Instead diversifying, staying invested and avoiding the temptation to make changes based on short-term predictions may increase the likelihood of consistently capturing what upside the stock market has to offer.

Monthly US stock returns are defined as the monthly return of the Fama/French Total US Market Index and are compared to contemporaneous monthly changes in the effective federal funds rate. Bond yield changes are obtained from the Federal Reserve Bank of St. Louis