Moore UK have completed their second pulse survey of owner managed businesses (OMBs) across the UK. To gather the data for this factsheet, Moore conducted an online survey of 146 OMBs in February 2021. The respondents were all director level individuals. 70% were either the CEO/Managing Director (36%) or the Founder/Owner/Partner (34%).

Our report focuses on general business confidence, business performance during the pandemic and expectations on taxation increases in the March 2021 budget.

Confidence levels

The data collected in our latest survey shows that there was a decrease in OMBs’ confidence in meeting their revenue and performance targets and in the general outlook for the next 12 months compared to the data gathered in our last survey in October 2020.

| |

Feb 2021 |

Oct 2020 |

change |

| Meeting Revenue Target |

56% |

71% |

-15% |

| Meeting Profit Target |

49% |

68% |

-19% |

| General Outlook |

52% |

69% |

-17% |

Workforce and cash position

The survey revealed that 23% of OMBs reduced their workforce in the past three months, compared to the 20% that saw an increase. As in October 2020, smaller businesses were the most affected seeing a net difference of -11% compared to +6% among their larger counterparts. When looking at the next three months, 28% of OMBs expect their workforce will increase, compared to the 13% who anticipate a reduction. Again, smaller businesses were less optimistic. Larger businesses showed a net difference between increase and decrease of 24% while smaller businesses stood at 7%.

As one smaller business owner said, “We need to survive the early part of 2021. We need to restructure and grow steadily. Unfortunately, we will need to make redundancies.”

Not only is it in workforce reductions that smaller companies are most feeling the squeeze of Covid. 19% of smaller businesses are not confident they will meet their revenue targets in the next twelve months compared to 36% of larger companies, while 49% of smaller companies reported that their cash position had decreased in the last three months compared to 26% of larger companies, as shown in the table below:

| Turnover and Cash Positon |

ALL |

UNDER £1M TURNOVER |

OVER £1M TURNOVER |

| Turnover outlook - Positive |

54% |

50% |

58% |

| Turnover outlook - Neutral |

6% |

6% |

5% |

| Turnover outlook - Negative |

40% |

44% |

36% |

| |

|

|

|

| Cash Position |

|

|

|

| Cash in the last 3 months - Improved |

29% |

20% |

39% |

| Cash in the last 3 months - Constant |

34% |

32% |

36% |

| Cash in the last 3 months - Decreased |

38% |

49% |

26% |

When asked about future financing, 19% of respondents reported that they plan to access additional finance in the next three months. One might assume therefore that for those businesses that have reported cash reductions in the past three months, the reductions have not been significant enough for them to need to raise additional finance.

Commenting on business aspirations going forward, another respondent said “Survival and pivot to reposition ourselves in a changed marketplace. Face the burden of debt created by the economic tsunami that we have and still are experiencing.”

Management responsibilities

We asked respondents to tell us how confident they were on a scale of 0 (Low ) to 10 (High) in fulfilling their responsibilities in five areas of their businesses. The rankings were the same as in our previous survey in October 2020 as shown in the table below.

| |

Mean Score |

| Financial Management |

8.4 |

| People Management |

8.2 |

| Infrasturcture |

7.7 |

| Strategy implementation and KPIs |

7.5 |

| Sales and Marketing |

7.3 |

This time, we also asked respondents how likely they were on the same scale to invest in technology over the next 3 months to support their business in these areas:

| |

Mean Score |

| Financial Management |

5.8 |

| People Management |

4.9 |

| Infrasturcture |

4.3 |

| Strategy implementation and KPIs |

4.8 |

| Sales and Marketing |

4.5 |

Budget 2021

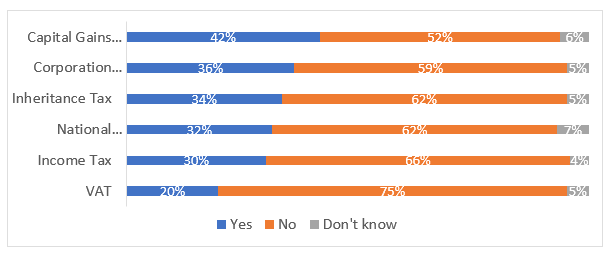

With the Chancellor of the Exchequer planning to announce his Budget on 3 March, and given the significant deficit created by the pandemic, we turned our attention to potential fiscal measures. We asked respondents to tell us which of the following taxes should increase .

Respondents gave a clear direction that they were against increases in the taxes shown in the table above, ranging from 52% against an increase in capital gains tax to 75% against any increase in VAT. It is interesting to note that the three taxes that yield the most revenue to the Exchequer were the three that respondents were least in favour of increasing.

One respondent commented “We are keen to execute on the projects we have in our pipeline and that nothing will impede these completing - so no fundamental changes to either the tax regime (e.g. CGT) or pulling back on government investment initiatives. In order to create greater sustainability in our business we need a growing economy where we can invest in bringing on new talented people and our systems.”

We also asked participants to tell us whether the Chancellor should announce some form of wealth tax on top of other tax increases. 39% of respondents were in favour. There was a significant divergence in the opinions of those who were against such a tax. 59% of those running larger businesses were against the introduction of some form of wealth tax compared to 41% of those in smaller businesses.

We then asked the 39% in favour of the introduction of some form of wealth tax which assets should be taxed. 53% were in favour of including family/privately owned businesses, 40% were in favour of including all assets and 28% were in favour of including the family home.

Finally, on Budget 2021 matters, we asked whether respondents expect the Chancellor to make certain incentives more generous now that the UK is in theory free from EU rules. 47% expect the Chancellor to make R&D relief and the Enterprise Investment Scheme/Seed Enterprises investment Scheme, while 35% expect more generous reliefs in the creative sector.

Brexit

Finally, we asked respondents to tell us on a scale of 0 (Low) to 10 (High) how well prepared they are for the impact of Brexit in 2021. Only 31% felt they were well prepared, 36% felt they were quite well prepared and 34% said they were not well prepared. Overall, the least well prepared were those not confident in meeting their targets and budgets over the next twelve months and those who see their workforce decreasing in the next three months.