- Coventry’s turnover almost doubles per annum, while London sees just 4% rise per annum over the same period

- UK-wide restaurant sales increased 7% per annum over two years

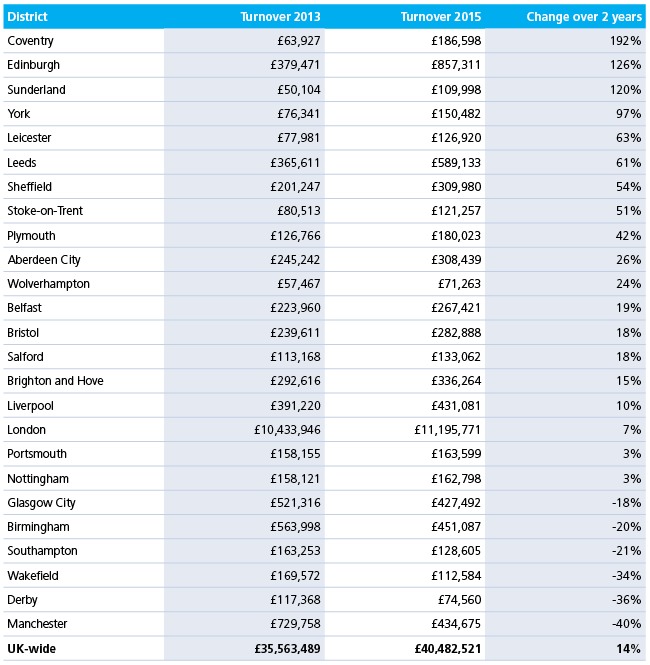

Coventry’s restaurants saw the fastest growth in turnover of the UK’s major cities over the long term, increasing at 96% per annum over two years to £187m in 2015 from £64m in 2013.

Comparatively, restaurant turnover in London rose just 4% per annum, to £11.2bn from £10.4bn* over the same period.

Many of the UK’s largest cities saw a drop in turnover in the restaurant sector – Glasgow saw a drop of 9% per annum to £427m from £521m over the same period, while Birmingham fell 10% per annum to £451m from £564m.

Over the long term, the restaurant market in London and many other large cities have become saturated with well-known chains and brands. As a result, many restaurants are expanding into ‘secondary’ regions, such as Coventry, where there is potentially less competition.

Simon Fowles, Director in Moore Hotels & Leisure group says: “Restaurant sector growth has been faster in the regions as they seek less crowded markets.

“Whilst disposable income is lower outside London, there is a far lower presence of modern, highly branded restaurant chains.

“Since this data on restaurant turnover was collected, there has been significant restructuring in Coventry’s Cathedral Lanes. It is likely that the increasing spread of upscale restaurants such as The Botanist will continue to enhance the already thriving industry in smaller cities like Coventry.

“Even prior to the Cathedral Lanes refurbishment, Coventry experienced significant growth. 49 restaurants and 45 takeaways opened just from 2013 to 2014**, showing how Coventry’s restaurant sector is catching up with other large cities.

“As there is a slight lag in the most recent data, it will be very interesting to see how trends in the restaurant sector will progress, particularly with regards to the continuing impact of Brexit on consumer sentiment.”

Restaurant turnover in the UK grew 7% per annum over two years, as chains increasingly utilise delivery operators

UK-wide, restaurant turnover grew 7% per annum***, to £40.5bn in 2015 from £35.6bn in 2013 as restaurants increasingly adapt to and make use of popular food delivery operators.

Delivery apps such as UberEATS and Deliveroo continue to grow substantially, and now make up a major slice of the market. For example, Just Eat saw customers made 136.4m orders in 2016, up 42% from 96.2m in 2015****.

Delivery operators, like many restaurants, are increasingly spreading to ‘secondary’ cities where they can capitalize on less saturated and competitive markets.

Simon adds: “Many restaurants are now using delivery operators as they seek to capture a bigger slice of consumer spending.

“Overall, UK restaurants are still enjoying strong growth, hitting above the £40bn mark last year. This suggests that there is still demand for high quality food and dining experiences, with plenty of new openings and an ever-increasing range of cuisines on offer.”

For information or to discuss further, please contact

Simon Fowles.

Coventry was the top-performing city in the UK for restaurant turnover over the long term (192%), while London lags behind:

* Data from 2013-15, the most recent years available

** Data from Coventry City Council

*** Data from an average of UK local authorities/districts

****Just Eat’s 2016 annual report