2024: a year of two halves

- Foreign investment in UK manufacturing and distribution businesses continued to climb since Q2 2023’s low point, with volume gaining pace in H2 2024.

- After the UK election, there was a sense of political stability, which boosted transaction activity until the Budget affected confidence.

- Activity is set to increase as investors seek to deploy capital amidst declining interest rates.

- AI can play a role in helping businesses to boost efficiencies in the face of increased costs following the Budget.

- The UK may sidestep US tariffs – an unexpected Brexit twist that could boost global trade.

Overseas investment in UK manufacturing continues to grow

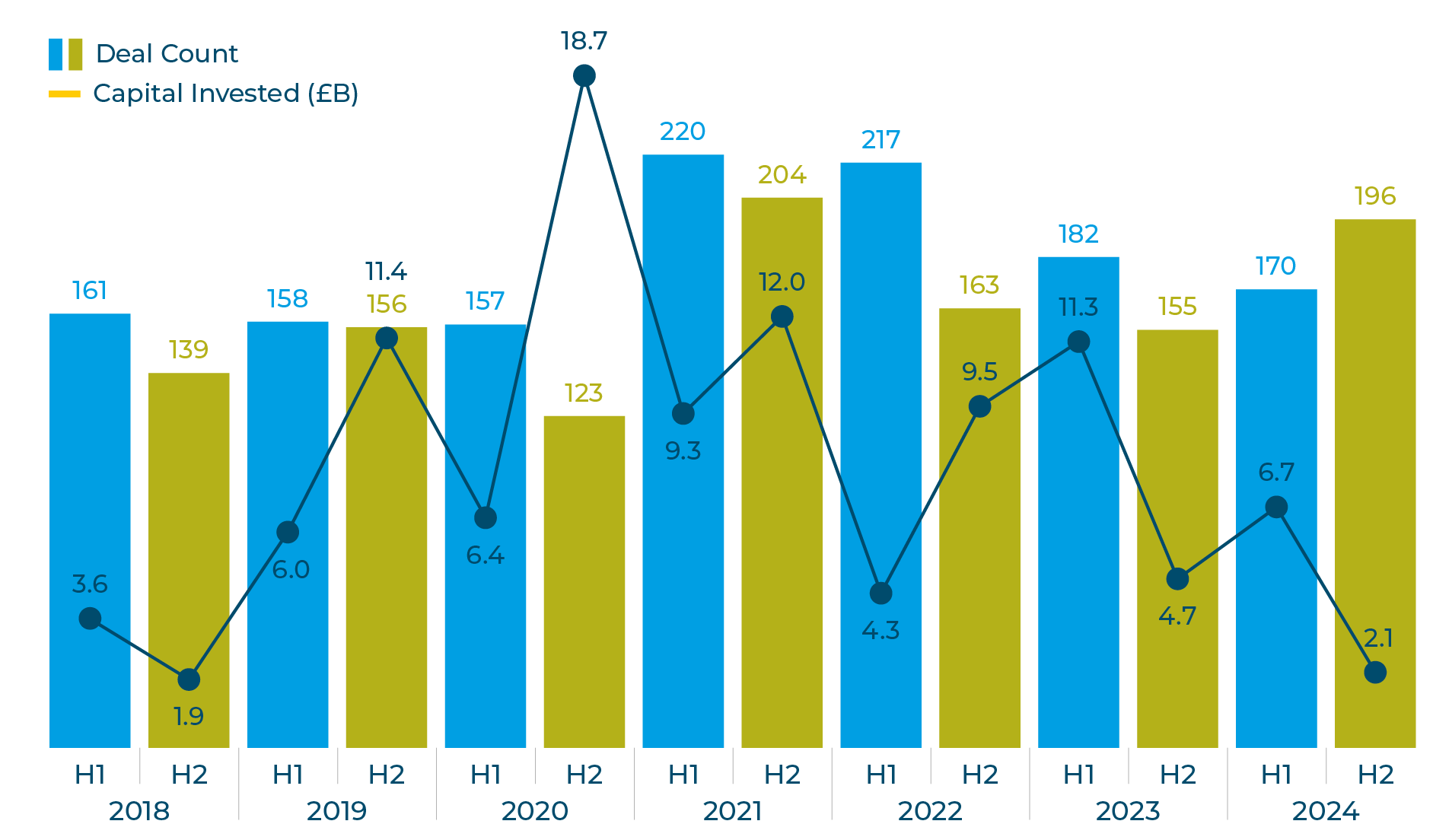

Foreign investment in UK manufacturing and distribution businesses has continued its climb in value and volume since a low point in H2 2023, with the growth in deal volume gaining pace in H2 2024.

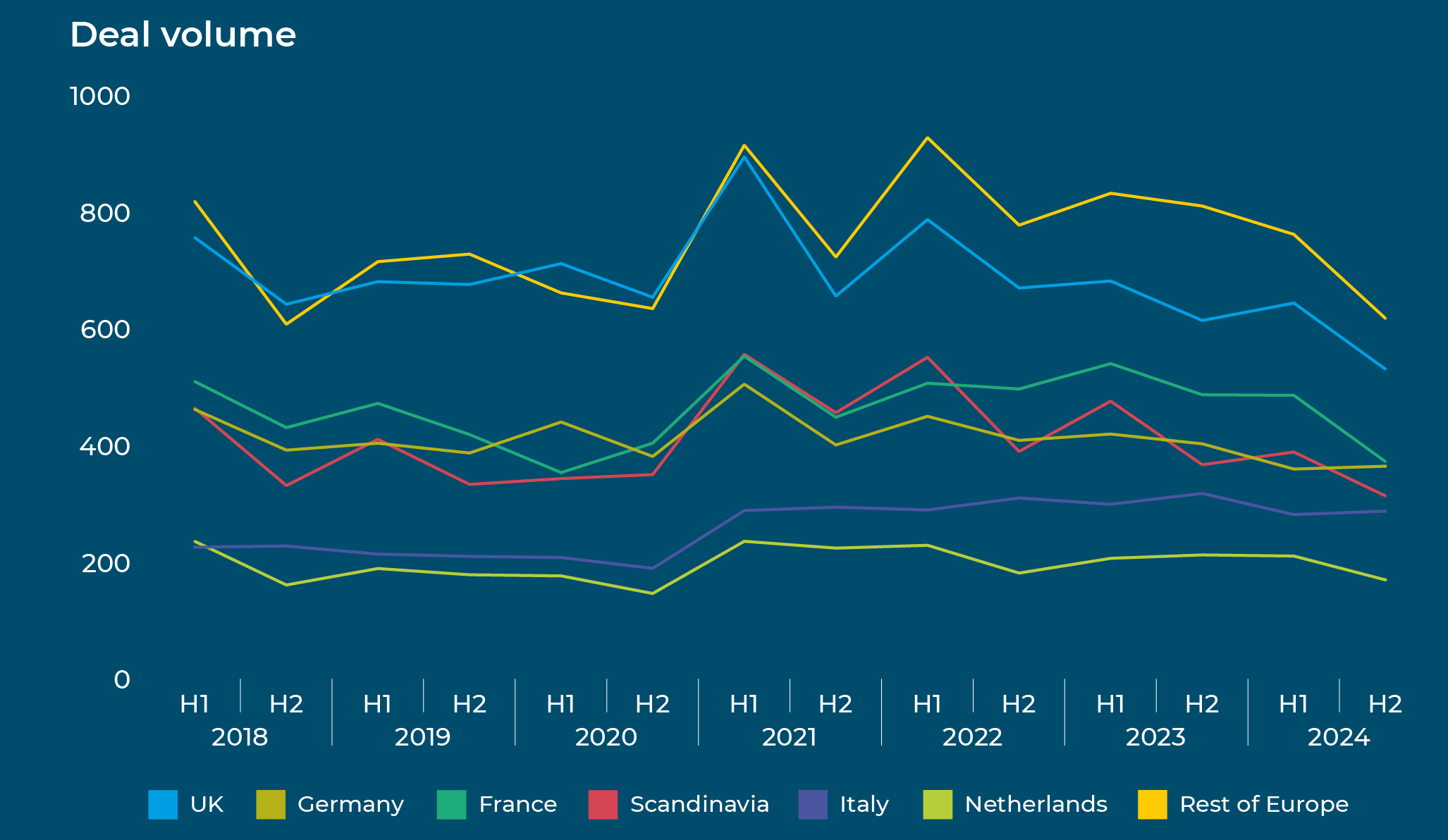

UK manufacturing still leads Europe

UK manufacturing and distribution continues to lead Europe in terms of transaction volume, capturing a fifth (21%) of all deals in FY 2024.

While it retains the largest share of activity, UK investments were down 9% in 2024 on 2023 levels as a strong first half gave way to a quieter H2. This was the case among many geographies, with Germany and Italy being notable exceptions.

Total European deal volume continues to see a steady decline since the high point in Q1 2021 (2,198 deals completed), with Q4 2024 recording just 1,362 deals.

The second half of last year induced whiplash for many in the UK: the Q3 24

Make UK Manufacturing report, covering precisely the period between the election and the Budget, revealed business confidence among its highest level since the survey began in 2014. Nearly 60% of firms anticipated stronger economic growth over the year ahead, deeming there to be greater political stability, with only 6% foreseeing a decline in GDP under the new government. Moore Kingston Smith witnessed a surge in companies seeking to close transactions before the Budget as they feared very large increases in capital gains tax.

A quarter later, the market changed after the Budget introduced a national insurance rise for businesses, carry tax increase in 2026 for private equity firms and inheritance tax changes for individuals.

According to

Reuters, the UK Manufacturing Purchasing Managers’ Index (PMI) reflects a fall in confidence, marking the sharpest contraction in nine months, as it fell from 49.9 in October to 48.0 in November and 47 in December. Contributing factors are the Budget as well as wider global economic issues, with increased employment taxes, minimum wage and capital gains tax (albeit gentler than anticipated). Small companies have been particularly affected, reporting marked drops in output, new orders and export business, as operational costs for manufacturers are driven up, putting pressure on profitability and investment capacity.

If the UK Budget impacted British manufacturing businesses, the US presidential election a week later concerned the global economy as Donald Trump threatened high global tariffs. It remains to be seen how the UK and Europe will fare as Canada, Mexico and China have had tariffs imposed on their exports to the US.

The good news for manufacturing and distribution businesses is the potential that AI can offer in terms of streamlining operations and creating cost-saving efficiencies. AI is set for a boost in the UK after the government published their AI opportunities action plan. A recent

Make UK publication reports that, while 75% of UK manufacturers plan to increase AI investment, only 16% feel knowledgeable about its applications. The benefits of properly harnessing AI are plenty and growing

(see here).